arizona charitable tax credit list 2021

Tax Credit gifts made between January 1 2021 and December 31 2021 are required to be listed on Part 1 section A of Arizona Form 321. We covered the most important information needed to fully utilize the Arizona Charitable Tax.

The Main Takeaways for the Arizona Charitable Donation Tax Credit.

. In 2019 over 4 million tax credit dollars were donated to GiveLocalKeepLocal charities. Electric Vehicle Tax Credits In Arizona Tax credits. Here are some of the differences your contributions made.

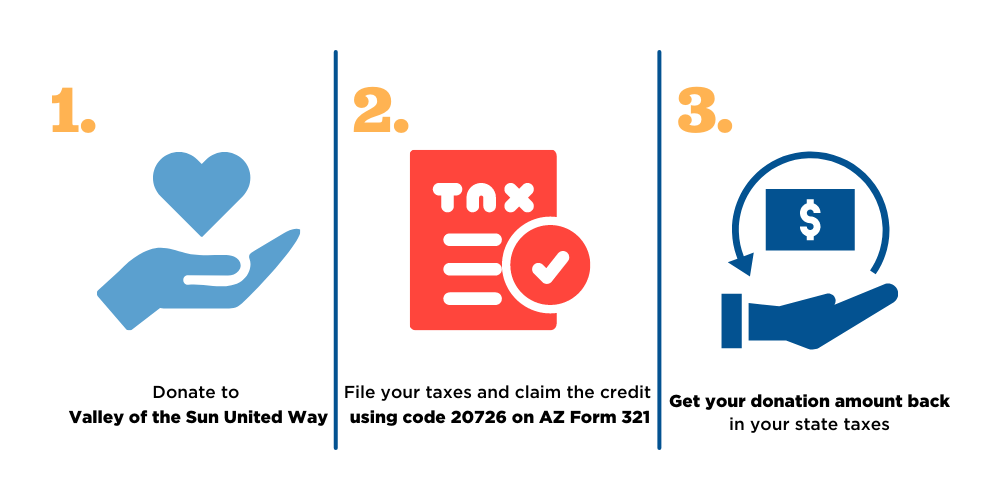

Through the Arizona Charitable Tax Credit Arizona taxpayers have an added incentive to make a donation and receive a dollar-for-dollar tax creditDonate up to 400 single filer and up to 800. There you have it. The deadline for making a charitable donation for the 2021 tax year is April 15 2022.

Related

Our QCO code is 20544. This change is in effect until June 30 2022. The maximum credit allowed is 800 for married filing joint.

A married couple making 60000 owing 1800 in taxes and donating 800 to a. Through the Arizona Charitable Tax Credit Arizona taxpayers have an added incentive to make a donation and receive a dollar-for-dollar tax credit. There are two tax credits available to individual income taxpayers for charitable donations.

Marys Food Bank is an Arizona Local Nonprofit Charity that distributes Food to the Hungry in Arizona. Every Arizona taxpayer who donates to Sojourner Center. The tax credit is claimed on Arizona Form 348.

Donate up to 400 single filer and up to 800. The maximum allowable credit for contributions to public schools is 400 for married filing jointly filers or 200 for single married filing. The Arizona Foster Care Tax Credit allows your donations to qualifying organizations to be a 100 tax credit and will reduce dollar-for-dollar the amount you owe for state income tax.

Through the Arizona Charitable Tax Credit Arizona taxpayers have an added incentive to make a donation and receive a dollar-for-dollar tax credit. List Sojourner Center as your charitable organization along with your donation amount on AZ Form 321. Control Alt Delete is a federally designated 501 c3 nonprofit and may be claimed as a deduction on federal taxes.

One for donations to Qualifying Charitable Organizations and one for donations to Qualifying Foster Care Charitable Organizations. 5000 high quality books given to low. For the Arizona Foster Care Tax Credit that amount is 1000 for married couples filing jointly and 500 for individual taxpayers and married couples filing separately.

Marys Food Bank is so efficient with donations that every 1 donated can provide. Donate up to 400 single filer and up to 800. Give your Arizona Charitable Tax.

Tax credits are more. Individuals making cash donations made to these charities may claim these tax credits on. With every dollar an individual can claim as a tax credit tax obligation is reduced by a dollar.

Ways To Give Special Olympics Arizona

Arizona Charity Donation Tax Credit Guide Give Local Keep Local

Free Goodwill Donation Receipt Template Pdf Eforms

Know Each Tax Credit S Limit 2021 Fsl Org

State Income Tax Rates And Brackets 2021 Tax Foundation

Peloton Opening New Customer Support Center In Tempe Arizona Peloton Buddy

Certification For Qcos And Qfcos Arizona Department Of Revenue

Donate Your Arizona Charitable Tax Credit Habitat Central Az

Ways To Give Special Olympics Arizona

Arizona Charity Donation Tax Credit Guide Give Local Keep Local

Home State Of Arizona State Employees Charitable Campaign

Free Arts Foster Care Tax Credit Free Arts

Az Charitable Tax Credit Foster Care And Charitable Tax Credit

Arizona Charitable Tax Credit Donations St Mary S Food Bank

Tax Credit Child Crisis Arizona Qualifying Foster Care Organization

Qualified Charitable Organizations Az Tax Credit Funds

Qualified Charitable Organizations Az Tax Credit Funds