does kentucky have sales tax on cars

The buyer will have to pay the sales tax when they get the car registered under their name. Labor and services such as car repair landscaping janitorial services and.

Title Transfer Or Title Registration Global Multi Services Truck Stamps Trucking Companies Commercial Vehicle

There are no local sales and use taxes in Kentucky.

. This way you dont have to pay a sales tax on your car in the new state when you re-register it. Counties and cities are not allowed to collect local sales taxes. The Kentucky state sales tax rate is 6 and the average KY sales tax after local surtaxes is 6.

Hmm I think. Kentucky has a flat income tax rate of 5 a statewide sales tax of 6 and property taxes that average 1257 annually. Any vehicles which are not considered to be subject to motor vehicle usage tax will be subject to the general sales and use tax.

Kentucky Sales and Use Tax is imposed at the rate of 6 percent of gross receipts or purchase price. The tax is collected by the county clerk or other officer with whom the vehicle is. On used vehicles the usage tax is 6 of the current average retail as listed in the Used Car Guide or 6 of the total consideration paid.

In the state of Kentucky they are considered to be exempt from the general sales and use tax so long as the motor vehicle usage was tax paid. Kentucky has a flat income tax rate of 5 a statewide sales tax of 6 and property taxes that average 1257 annuallyBoth the sales and property taxes are below the national averages while the state income tax is right around the US. Applies to the retail sale of new motor vehicle tires sold in Kentucky.

Depending on where you live you pay a percentage of the cars assessed value a price set by the state. Several exceptions to the state sales tax are. KRS 22450-868 1 per tire sold at retail.

The Kentucky use tax should be paid for items bought tax-free over the internet bought while traveling or transported into Kentucky from a state with a lower sales tax rate. 2022 Kentucky state sales tax. Sales Tax Exemptions in Kentucky.

In addition to taxes car purchases in Kentucky may be subject to other fees like registration title and plate fees. Though the sales tax is a moderate 6 huge income tax benefits and exemptions make it a place to be for retirees. Imagine that your monthly lease payment is 500 and your states sales tax on a leased car is 6.

Groceries and prescription drugs are exempt from the Kentucky sales tax. It is levied at 6 percent and shall be paid on every motor vehicle used in Kentucky. There are two unique aspects of Kentuckys tax system.

You can find these fees further down on the page. 500 X 06 30 which is what you must pay in sales tax each month. This page discusses various sales tax exemptions in Kentucky.

However Kentucky sales tax does not apply to motor vehicles covered under the motor vehicle usage tax exemption for nonresident military personnel under KRS 1384704. If 000 is the sale price then the tax is based off of 6 of the NADA current months retail value of the vehicle. If the vehicle is registered in Kentucky sales tax.

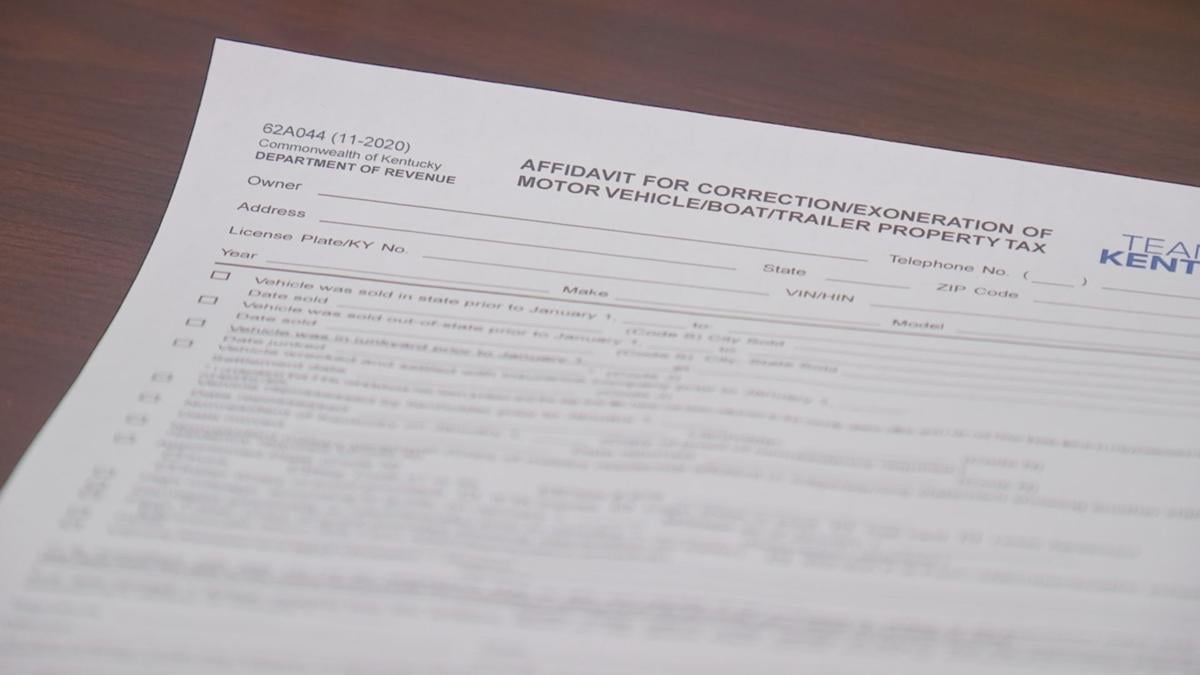

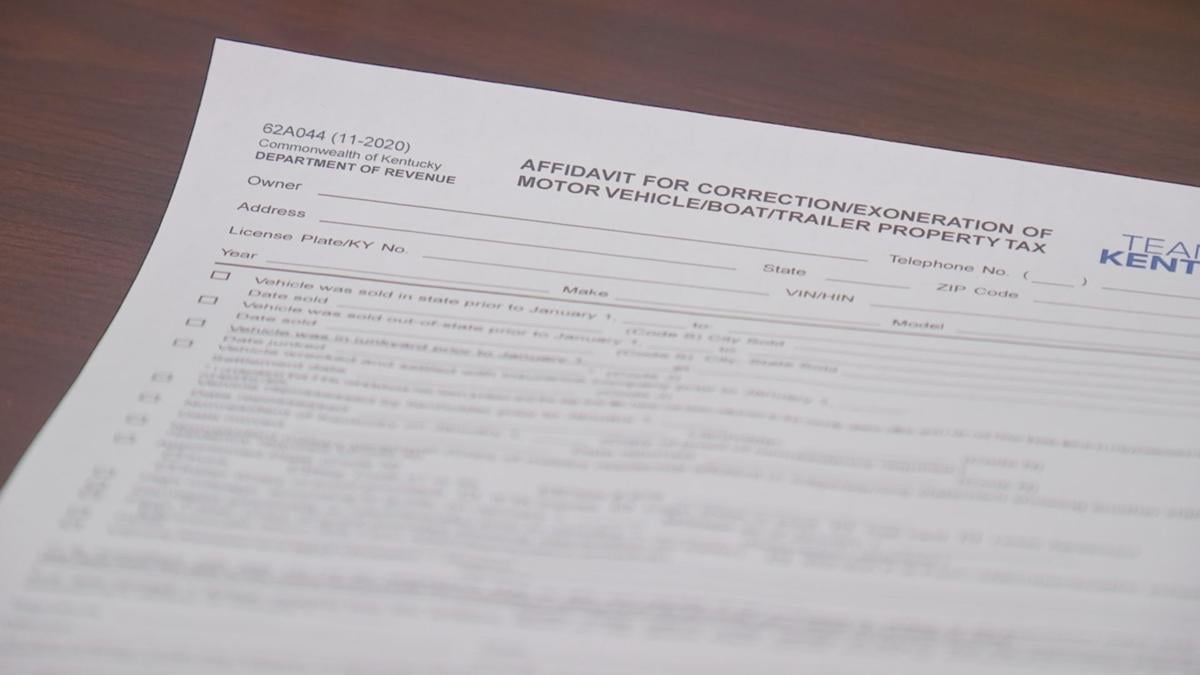

Property Valuation Administrators PVAs in each county must list value and assess the property tax on motor vehicles and motor boats as of January 1 st of each year. Can sales tax be refunded. Are services subject to sales tax in Kentucky.

Sales Tax Paid to a Kentucky Vendor S9 - attach a copy of the receipt from the seller. Yes there is no sales tax exemption that applies specifically to military personnel. There are some other loopholes too.

Exempt Grocery Food The current sales and use tax exemption for food items under KRS 139485 has been in effect since 1972. Exact tax amount may vary for different items. Classic cars have a rolling tax exemption ie vehicles manufactured more than 40 years before 1 January of that year are automatically exempt from sales tax and vehicles used for certain types of forestry and agriculture are as well.

Sales and Use Tax Laws are located in Kentucky Revised Statutes Chapter 139 and Kentucky Administrative Regulations - Title 103. Yes sales tax may be refunded through the clerks office if the transaction occurs within the same week as the original transaction. Previously taxed services included those which modify or repair a product.

Certain states allow their dealerships to collect road usage tax from Kentucky. Usage Tax A six percent 6 motor vehicle usage tax is levied upon the retail price of vehicles transferred in Kentucky. If gift is the sale price then tax is based off of 6 of the NADA current months trade in value of the vehicle.

Motor Vehicle Usage Tax is a tax on the privilege of using a motor vehicle upon the public highways of the Kentucky and shall be separate and distinct from all other taxes imposed by the Commonwealth. Credit for Sales Tax Paid Out of State S8 - attach a copy of the receipt from the seller. Motor Vehicle Usage Tax.

Does Kentucky have tax on food. Payment should be made to the County. Does kentucky have a state sales tax.

Kentucky imposes a flat income tax of 5The tax rate is the same no matter what filing. Sales tax for a leased vehicle is calculated based on the states tax percentage and the cost of the lease payments. Sales of recapped tires are exempt from the fee.

Kentucky collects a 6 state sales tax rate on the purchase of all vehicles. While the Kentucky sales tax of 6 applies to most transactions there are certain items that may be exempt from taxation. Many states have a sales and use tax exemption for food primarily to relieve the tax burden on those who spend a relatively large portion of their income on grocery food.

Every year Kentucky taxpayers pay the price for driving a car in Kentucky. In Kentucky certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. On this page we have gathered for you the most accurate and comprehensive information that will fully answer the question.

KRS 1322201aThe person who owns a motor vehicle on January 1 st of the year is responsible for paying the property taxes for that vehicle for the year. Does kentucky have a state sales tax. Does not apply to new cars brought into the state for sale or use.

Both the sales and property taxes are below the national averages while the state income tax is right around the US. Do not let a buyer tell you that you are supposed to pay the sales tax. Does kentucky have a state sales tax.

Looking for an answer to the question. The state of Kentucky does not usually collect sales taxes on the many services performed but in 2018 passed laws broadening the base of which services can be taxed. 90 of the Manufacturers Suggested Retail Price MSRP or Window Sticker.

The state of Kentucky KY has a statewide sales tax rate of 6Kentucky was listed in Kiplingers 2011 10 tax-friendly states for retirees.

Ky Lawmakers Could Have Ended The Car Tax They Now Pledge To Curb Lexington Herald Leader

Cash For Your Car In Kentucky Free Same Day Pickup Car Title Kentucky Id Card Template

When Ford Opened Its First Plant In Louisville The Assembly Line Process Utilized Was State Of The Art In Advanced Manufactu Ford Motor Assembly Line Car Ford

Kentucky Vehicle Valuations Increase By 40 Here S What You Can Do If Your Car S Value Jumps This Year News Wpsd Local 6

Where S My Kentucky State Tax Refund Taxact Blog State Tax Tax Refund Kentucky State

What S The Car Sales Tax In Each State Find The Best Car Price

Sales Tax On Cars And Vehicles In Kentucky

Kentucky Vehicle Valuations Increase By 40 Here S What You Can Do If Your Car S Value Jumps This Year News Wpsd Local 6

Vintage Cadillacs Paducah Paducah Kentucky Used Cars And Trucks

Kentucky Drivers Face Higher Tag Prices Due To Rising Value Of Used Vehicles

In State Transfers Daviess County Kentucky

What Is Irp Plates Renewal Irs Forms Trucking Companies Renew

Nascar Official Home Race Results Schedule Standings News Drivers Nascar Heat Paint Schemes Nascar Racing

History And Heritage Kentucky Trailer 1 888 598 7245 Antique Cars Classic Cars Beautiful Cars

Nj Car Sales Tax Everything You Need To Know

Kentucky Drivers Face Higher Tag Prices Due To Rising Value Of Used Vehicles

Kentucky Lawmakers Addressing Rising Motor Vehicle Tax Bills